The independent source for health policy research, polling, and news.

The independent source for health policy research, polling, and news.

Lunna Lopes, Marley Presiado, and Liz Hamel

Published:

For many years, KFF polling has found that the high cost of health care is a burden on U.S. families, and that health care costs factor into decisions about insurance coverage and care seeking. These costs rank as a top financial worry and health care affordability is one of the top issues that voters want to hear candidates talk about during the 2024 election. This data note summarizes recent KFF polling on the public’s experiences with health care costs. Main takeaways include:

Many U.S. adults have trouble affording health care costs. While lower income and uninsured adults are the most likely to report this, those with health insurance and those with higher incomes are not immune to the high cost of medical care. About half of U.S. adults say that it is very or somewhat difficult for them to afford their health care costs (47%). Among those under age 65, uninsured adults are much more likely to say affording health care costs is difficult (85%) compared to those with health insurance coverage (47%). Additionally, at least six in ten Black adults (60%) and Hispanic adults (65%) report difficulty affording health care costs compared to about four in ten White adults (39%). Adults in households with annual incomes under $40,000 are more than three times as likely as adults in households with incomes over $90,000 to say it is difficult to afford their health care costs (69% v. 21%). (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

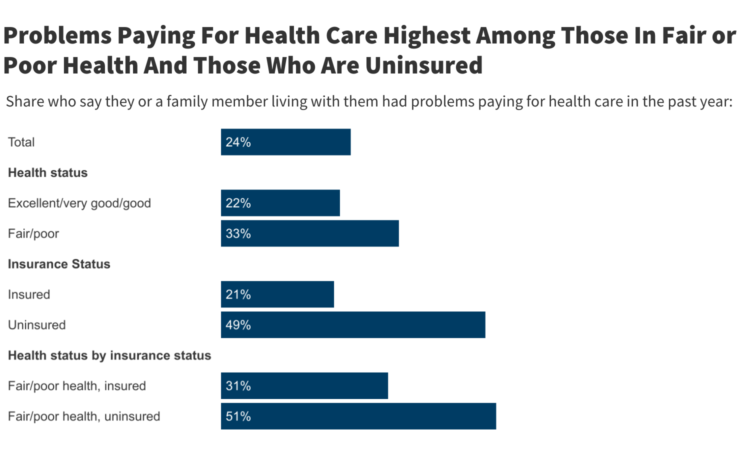

When asked specifically about problems paying for health care in the past year, one in four adults say they or a family member in their household had problems paying for care, including three in ten adults under age 50 and those with lower household incomes (under $40,000). Affording health care is particularly a problem for those who may need it the most as one-third of adults who describe their physical health as “fair” or “poor” say they or a family member had problems paying for health care in the past 12 months. Among uninsured adults, half (49%) say they or a family member in their household had problems paying for health care, including 51% of uninsured adults who say they are in fair or poor health.

The cost of care can also lead some adults to skip or delay seeking services. One-quarter of adults say that in the past 12 months, they have skipped or postponed getting health care they needed because of the cost. The cost of care can also have disproportionate impacts among different groups of people; for instance, women are more likely than men to say they have skipped or postponed getting health care they needed because of the cost (28% vs. 21%). Adults ages 65 and older, most of whom are eligible for health care coverage through Medicare, are much less likely than younger age groups to say they have not gotten health care they needed because of cost.

One in four immigrant adults (22%) say they have skipped or postponed care in the past year, rising to about a third (36%) among those who are uninsured. Seven in ten (69%) of immigrant adults who skipped or postponed care (15% of all immigrant adults) said they did so due to cost or lack of health coverage. (Source: The 2023 KFF/LA Times Survey of Immigrants: Apr.-June 2023)

Six in ten uninsured adults (61%) say they have skipped or postponed getting health care they needed due to cost. Health insurance, however, does not offer ironclad protection as one in five adults with insurance (21%) still report not getting health care they needed due to cost.

KFF health polling from March 2022 also looked at the specific types of care adults are most likely to report putting off and found that dental services are the most common type of medical care that people report delaying or skipping, with 35% of adults saying they have put it off in the past year due to cost. This is followed by vision services (25%), visits to a doctor’s offices (24%), mental health care (18%), hospital services (14%), and hearing services, including hearing aids (10%). (Source: KFF Health Tracking Poll: March 2022)

A 2022 KFF report found that people who already have debt due to medical or dental care are disproportionately likely to put off or skip medical care. Half (51%) of adults currently experiencing debt due to medical or dental bills say in the past year, cost has been a probititor to getting the medical test or treatment that was recommended by a doctor. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

For many U.S. adults, prescription drugs are a component of their routine care. More than one in four (28%) adults say it is either “somewhat” or “very difficult” for them to afford to pay for prescription drugs. Affording prescription drugs is particularly difficult for adults who take four or more prescription medications (37%) and those in households with annual incomes under $40,000 (40%). Black and Hispanic adults are also more likely than White adults to say it is difficult for them to afford to pay for prescription drugs. (Source: KFF Health Tracking Poll: July 2023)

The high cost of prescription drugs also leads some people to cut back on their medications in various ways. About one in five adults (21%) say in the past 12 months they have not filled a prescription because of the cost. A similar share (21%) say they have taken an over-the-counter drug instead of getting a prescription filled – rising to about one third of Hispanic adults (32%) and more than one in four adults (27%) with annual household incomes under $40,000. About one in ten adults say that in the past 12 months they have cut pills in half or skipped doses of medicine due to cost. (Source: KFF Health Tracking Poll: July 2023)

Overall, most insured adults rate their health insurance as “excellent” or “good” when it comes to the amount they have to pay out-of-pocket for their prescriptions (61%), the amount they have to pay out-of-pocket to see a doctor (53%), and the amount they pay monthly for insurance (54%). However, at least three in ten rate their insurance as “fair” or “poor” on each of these metrics, and affordability ratings vary depending on the type of coverage people have.

Adults who have private insurance through employer-sponsored insurance or Marketplace coverage are more likely than those with Medicare or Medicaid to rate their insurance negatively when it comes to their monthly premium, the amount they have to pay out of pocket to see a doctor, and their prescription co-pays. About one in four adults with Medicare give negative ratings to the amount they have to pay each month for insurance and to their out-of-pocket prescription costs, while about one in five give their insurance a negative rating when it comes to their out-of-pocket costs to see a doctor.

Medicaid enrollees are less likely than those with other coverage types to give their insurance negative ratings on these affordability measures (Medicaid does not charge monthly premiums in most states, and copays for covered services, where applied, are required to be nominal.) (Source: KFF Survey of Consumer Experiences with Health Insurance)

In June 2022, KFF released an analysis of the KFF Health Care Debt Survey, a companion report to the investigative journalism project on health care debt conducted by KFF Health News and NPR, Diagnosis Debt. This project found that health care debt is a wide-reaching problem in the United States and that 41% of U.S. adults currently have some type of debt due to medical or dental bills from their own or someone else’s care, including about a quarter of adults (24%) who say they have medical or dental bills that are past due or that they are unable to pay, and one in five (21%) who have bills they are paying off over time directly to a provider. One in six (17%) report debt owed to a bank, collection agency, or other lender from loans taken out to pay for medical or dental bills, while similar shares say they have health care debt from bills they put on a credit card and are paying off over time (17%). One in ten report debt owed to a family member or friend from money they borrowed to pay off medical or dental bills.

While four in ten U.S. adults have some type of health care debt, disproportionate shares of lower income adults, the uninsured, Black and Hispanic adults, women, and parents report current debt due to medical or dental bills.

A July 2022 KFF Health Tracking Poll shows that unexpected medical bills are near the top of the list of people’s financial worries, with about two-thirds of the public saying they are at least somewhat worried about affording unexpected medical bills for themselves and their family (64%). Similar shares say they worry about affording monthly utilities like electricity (62%) and affording food (61%). About half of adults say they worry about affording their rent or mortgage (51%), and 46% worry about being able to afford prescription drugs for themselves and their family. Adults with health insurance are not immune from worries about affording care, as at least four in ten say they worry about affording their health insurance deductible (48%) and their monthly health insurance premium (40%). Those with lower household incomes were more likely to be worried about each of these things. (Source: KFF Health Tracking Poll: July 2022)

Many U.S. adults may be one unexpected medical bill from falling into debt. About half of U.S. adults say they would not be able to pay an unexpected medical bill that came to $500 out of pocket. This includes one in five (19%) who would not be able to pay it at all, 5% who would borrow the money from a bank, payday lender, friends or family to cover the cost, and one in five (21%) who would incur credit card debt in order to pay the bill. Women, those with lower household incomes, Black and Hispanic adults are more likely than their counterparts to say they would be unable to afford this type of bill. (Source: KFF Health Care Debt Survey: Feb.-Mar. 2022)

Among older adults, the costs of long-term care and support services are also a concern. Almost six in ten (57%) adults 65 and older say they are at least “somewhat anxious” about affording the cost of a nursing home or assisted living facility if they needed it, and half say they feel anxious about being able to afford support services such as paid nurses or aides. These concerns also loom large among those between the ages of 50 and 64, with more than seven in ten saying they feel anxious about affording residential care (73%) and care from paid nurses or aides (72%) if they were to need these services. See The Affordability of Long-Term Care and Support Services: Findings from a KFF Survey for a deeper dive into concerns about the affordability of nursing homes and support services.

KFF Headquarters: 185 Berry St., Suite 2000, San Francisco, CA 94107 | Phone 650-854-9400

Washington Offices and Barbara Jordan Conference Center: 1330 G Street, NW, Washington, DC 20005 | Phone 202-347-5270

www.kff.org | Email Alerts: kff.org/email | facebook.com/KFF | twitter.com/kff

The independent source for health policy research, polling, and news, KFF is a nonprofit organization based in San Francisco, California.